Contents

Last updated October 10, 2023

Every piece we write is researched and vetted by a former admissions officer. Read about our mission to pull back the admissions curtain.

Should I take out loans for college?

Admissions officer reviewed by

Ben Bousquet, M.Ed

Former Vanderbilt University

Written by

Alex McNeil, MA

Admissions Consultant

Key Takeaway

If you’ve turned on the news in the past three years, you’ve probably heard a lot of hubbub about student loans.

Student loan forgiveness, interest rates, scams, regret—you name it.

But the reality is that most students and families can’t cover the cost of college out-of-pocket, even lower-cost options like community colleges.

Without the ability to pay out-of-pocket, you’ll need to rely on need-based aid, merit aid, and, yes, student loans.

There are lots of considerations that go into making decisions about student loans, and this post is here to guide you through them.

Let's dive in.

Why “Should I take out student loans?” isn’t the best question to be asking

Let's clear one thing up: the question "should I take out student loans" isn't exactly the question you should be asking.

The truth is, for many families, student loans are necessary to finance a college education. Most financial aid packages don’t cover the full cost of tuition or room and board. If you’re not able to pay for those expenses outright, then you’ll probably need to look into loans.

That’s why in 2021 the median student loan debt ranged from $20,000 to $25,000.

The real question, then, isn't if you should take out loans. Instead, you should be asking: "What types of loans should I consider to pay for my education?"

How to figure out if you’ll need loans

Before you can answer what types of loans you should consider, you need to figure out whether you do fall into the majority of people who need loans for college.

Start by exploring the net price calculators provided by the schools you're interested in. These calculators give you an estimate of your Expected Family Contribution (EFC) towards your college costs. Put in all your financial information, and the calculator will give you an approximation of the aid you’ll receive.

The “Net Price” the calculator determines will be the estimated amount you’ll have to pay to attend the school. If the amount is more than you would be able to afford from your bank account or savings, then you would need additional funding to attend.

Let’s take Harvard’s Net Price Calculator as an example. Student A lives in Vermont with a family of four people, only one of whom will be attending college. We’ll say that their gross household income is $100,000. For simplicity’s sake, we’ll also say that there are no other sources of income or assets.

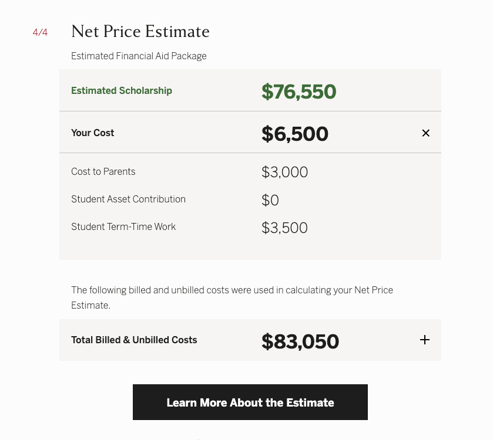

Here’s what Harvard’s net price calculation looks like:

We can see that Harvard estimates that the student will receive $76,550 in scholarships, leaving them with a net price of $6,500 per year. (Be careful here because some schools may include loans in the “estimated scholarship” amount.) Harvard assumes that the student will be able to work to earn $3,500 to put to this net cost and that the parents will pay $3,000.

If you and your family won’t be able to collectively cover that $6,500 for the year, then you’ll need to find additional scholarships or take out a loan.

The different types of student loans

Once you’ve determined whether you need loans in the first place, you’ll want to look into what kind of loans to get.

Keep in mind that not all loans are created equal. There are different types of student loans available, each with its own terms and conditions.

Federal subsidized and unsubsidized loans are your best loan options. Subsidized loans offer low-interest rates that don't rack up interest while you’re in school. The amount of subsidized loans you’ll qualify for will depend on what the Free Application for Federal Student Aid (FAFSA) calculates as your EFC. If your EFC is too high, you may not qualify for subsidized loans at all.

Unsubsidized loans, on the other hand, are easier to qualify for, even if you do have a high EFC. The con to taking unsubsidized loans compared to subsidized loans is that your unsubsidized loans will charge interest while you’re in school. But unsubsidized loans are still a better option compared to private student loans because you’ll still benefit from a low interest rate.

Importantly, subsidized and unsubsidized loans are both types of federal loans. Because they’re federal loans, they’ll be eligible for repayment (or even forgiveness) programs like the Public Service Loan Forgiveness program.

There’s a lot of terminology here—I know! But hang in there. It’s important to know the differences between these kinds of loans so you’re an informed borrower.

So subsidized and unsubsidized loans are both kinds of federal loans taken out by the student. That means that if you’re the one going to college, the loans will be in your name. You’ll be expected to pay them back after you graduate, unless you qualify for a particular federal program.

The problem is, you only qualify for a certain amount in loans from the federal government. Sometimes those loans alone aren’t enough to cover the gap between your college funds and college costs.

That’s where Parent PLUS loans can come in. Unlike federal subsidized and unsubsidized loans, Parent PLUS loans are for—you guessed it—parents. That means that they get taken out under a parent’s or guardian’s name.

Parent PLUS loans are also federal loans that come from the US government. They have a fixed interest rate that is typically higher than federal subsidized and unsubsidized loans. But that interest rate is still lower than most private loans.

And lastly, there are private loans from private lenders. These usually come with high variable interest rates and less friendly repayment terms, and we don’t recommend taking them out if you can avoid it.

How to pick loans that are better for your finances

So, which loans should you pick? You should look at the interest rates and the terms of each loan. Student loans aren't dismissible in bankruptcy, so you're committed to repay whatever loans you take on.

If you’re going to take out loans, federal loans are better than private loans because they have lower interest rates and may also be eligible for specialized repayment plans or even forgiveness.

Of the federal student loans, subsidized loans are the best picks because they have low interest rates and won’t incur interest while you’re in school. In other words, you’ll save on four+ years of interest compared to other kinds of loans.

Unsubsidized loans, while not as attractive as subsidized ones, are still worth considering, especially if they’re the only federal loans you qualify for. You will have to pay interest that builds while you’re in college, but you can still benefit from the low interest rates and special repayment programs of federal loans.

Before you consider private loans, you should first consider Parent PLUS loans.

If you find yourself considering private loans, beware. These loans often carry high variable interest rates that can make repayment really difficult. If you can’t comfortably attend a college without taking out private loans, then you may need to rethink whether you should attend that school.

So as you’re building your school list, make sure you’re using the Net Price Calculators at each school you’re interested in and being realistic with yourself about whether you’d be able to afford to attend.

TL;DR

Paying for college with student loans is a reality for many families. Instead of wondering if you should take out loans, it's more useful to consider what types of loans to take out. Assess your Expected Family Contribution (EFC), understand the different types of loans available, and make choices based on interest rates and repayment terms. Subsidized and unsubsidized loans should be your first choice, followed by Parent PLUS loans. Approach private loans with caution.

.png)